Losing a loved one is incredibly difficult, and the complexities of life insurance can add to the emotional burden. This guide explains what happens when your primary beneficiary passes away before you and provides clear steps to navigate this situation. We'll cover beneficiary designations, claim procedures, potential challenges, and resources to support you through this. For additional legal guidance, see this helpful resource.

Understanding Beneficiary Designations: Who Gets the Money?

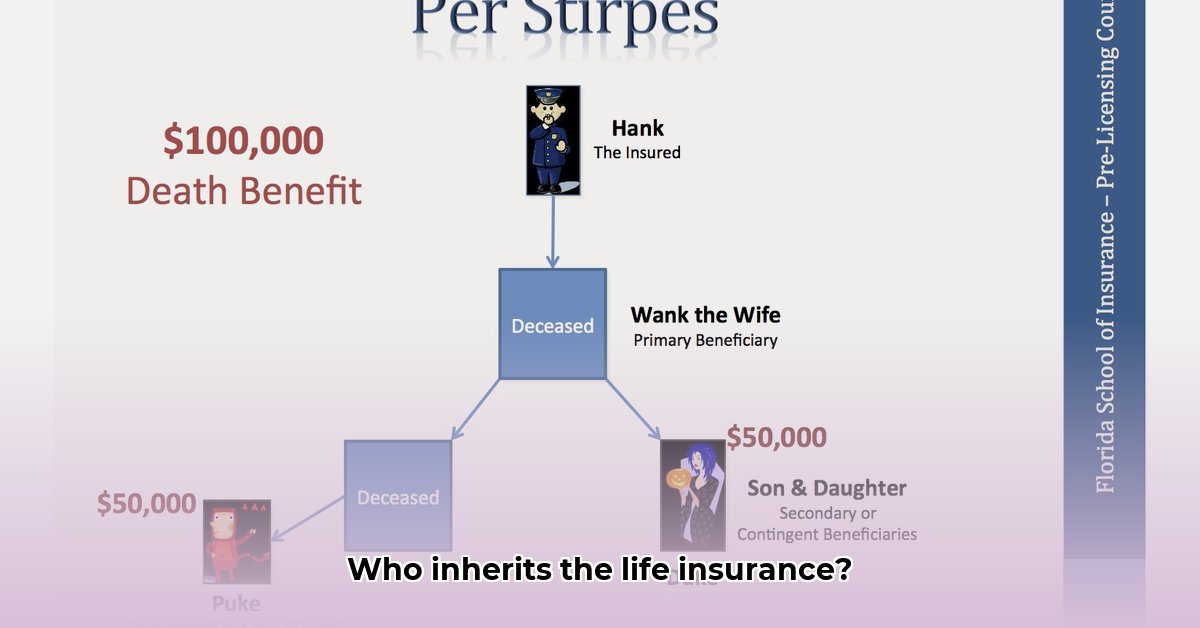

When you purchase life insurance, you name one or more beneficiaries to receive the death benefit (the payout) upon your passing. The primary beneficiary receives the funds first. If they predecease you, the money typically goes to the contingent beneficiary (your backup). Some policies have tertiary beneficiaries and beyond, creating a line of succession. Understanding this order is vital. Not having a contingent beneficiary can significantly complicate the payout process, often leading to probate (a court-supervised distribution of assets). Probate can be time-consuming, expensive, and emotionally draining.

What to Do After a Primary Beneficiary's Death: A Step-by-Step Guide

The death of a loved one is emotionally taxing. Allow yourself time to grieve. Once ready, take these steps:

Contact Your Insurance Company Immediately: Notify your insurer of the primary beneficiary's death. They'll guide you through the claim process. This is usually the first crucial step. The sooner you contact them, the faster the process will typically progress.

Review Your Policy: Locate your policy documents and review the beneficiary designations. Confirm the order of succession: primary, contingent, and any others listed.

Gather Necessary Documents: You will likely need the death certificate of the primary beneficiary, a copy of your insurance policy, and potentially other documentation. Your insurer will specify their requirements.

File Your Claim: Complete and submit the necessary claim forms as instructed by your insurance company. Retain copies of all documents for your records.

Review the Payout: Once the claim is processed, carefully check the payout amount to ensure accuracy and alignment with your policy and beneficiary information.

Potential Complications and Solutions: Addressing Challenges

Several issues can arise:

No Contingent Beneficiary: Without a designated contingent beneficiary, the death benefit likely goes through probate, a potentially lengthy and complex legal process.

Family Disputes: Disagreements among family members about the distribution of funds are unfortunately common. This can significantly slow down or complicate the claims process.

Unclear Policy Language: Ambiguous language in your policy can create confusion and lead to delays.

Solutions:

Proactive Planning: Clearly designating beneficiaries (primary and contingent) minimizes complications.

Legal Counsel: For disputes or unclear policy details, consult an estate planning attorney.

Seeking Legal Help: When Expert Guidance is Necessary

If you encounter complications—disputes, unclear policy language, or multiple beneficiaries—seeking legal counsel is strongly recommended. An estate planning attorney familiar with probate and insurance law can provide crucial guidance, protect your rights, and help resolve conflicts efficiently.

Emotional Support: Coping with Loss

Grief is a deeply personal process. Prioritize your emotional well-being. Don't hesitate to seek support from friends, family, grief counselors, or support groups. Many resources are available to help you through this difficult time. Remember that seeking help is a sign of strength.

Talking to Your Insurance Company: Key Questions to Ask

Prepare a list of questions beforehand for a smoother process:

- What documents are required to file a claim? (Ensures timely processing)

- What's the estimated processing time? (Sets realistic expectations)

- Who is my point of contact for questions? (Ensures clear communication)

- What steps are taken if a dispute arises? (Helps prepare for potential challenges)

- How will the death benefit be paid out? (Understand lump sum vs. annuity options)

Thorough planning, including clearly designating beneficiaries, significantly reduces potential future difficulties. Regularly review your life insurance policy and beneficiary information to reflect any life changes. This proactive approach provides peace of mind and protects your loved ones during a difficult period.